Who Pays Tariffs? And How Do We Know?

Imagine yourself as a small-business owner who produces something — say, plastic lawn ornaments — for American consumers. (One of my uncles actually was in that business.) Then for some reason, politicians propose imposing a tax of 25 percent or more on all sales of pink flamingos, garden gnomes, etc.

What will you do if that tax comes into effect? Will you pass the tax increase on to your customers, or will you try to keep consumer prices unchanged and absorb the tax yourself?

Well, you’ll certainly tell politicians that your customers will end up paying, and you’ll probably be telling the truth. Your costs, in effect, will increase, and your profit margin probably isn’t high enough to absorb the tax, even if you wanted to.

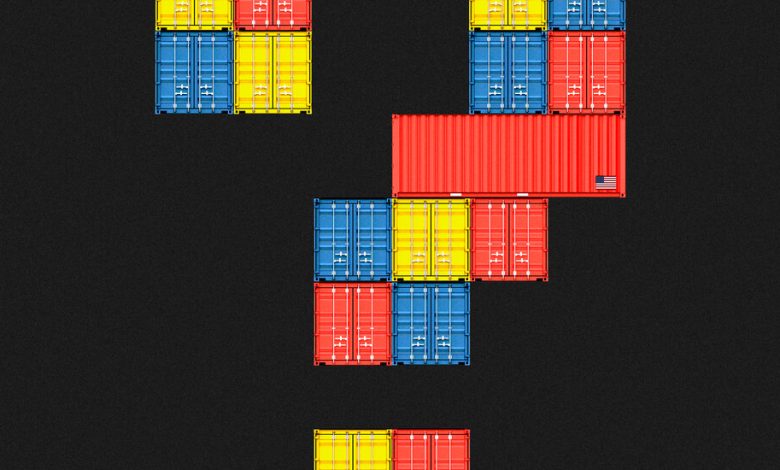

Now change the story a bit: You’re not an American small-business owner; you’re a Chinese company selling stuff to the United States — and the tax in question is a tariff, a charge levied on goods imported from China. Why should the answer be any different? Normally, we’d expect the tariff to be passed on to U.S. consumers.

Donald Trump, however, loves tariffs and insists that they are paid by foreigners. So leading Republicans, who increasingly seem to be using George Orwell’s “1984” as an instruction manual — whatever the leader says is true — have taken to claiming that tariffs (and only tariffs) are a tax on business that doesn’t hurt consumers. “The notion that tariffs are a tax on U.S. consumers is a lie pushed by outsourcers and the Chinese Communist Party,” a spokesperson for the Republican National Committee recently declared.

But how do we know that consumers really do pay for tariffs? I just tried to convince you with a thought experiment; I could also point to the fact that a vast majority of economists believe that tariffs are primarily paid by consumers. But not everyone finds thought experiments persuasive, and many people distrust economists. So can I offer any more direct evidence?