‘It’s Clearly Bleak’: Stocks Set for Longest Losing Streak in Months

Stocks are on course for their longest losing streak in many months, as geopolitical turmoil rattles Wall Street and investors slash their bets on the Federal Reserve cutting interest rates any time soon.

The S&P 500, one of the most widely followed stock indexes in the world, recorded a fifth consecutive decline on Thursday. Premarket trading on Friday was flat; a sixth straight day of losses would be the worst run since October 2022.

The slide has dragged the S&P 500 down by more than 2 percent for the week, setting it up for a fourth straight weekly decline. By that measure, it would be the longest weekly losing streak for the index since September, when concerns over rising government debt and a potential government shutdown compounded worries about the effects of high interest rates.

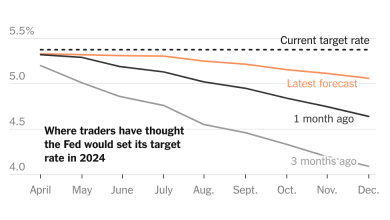

Those fears dissipated toward the end of last year as inflation cooled and investors began to bet that the Fed would soon cut rates, prompting a ferocious stock rally in the first three months of 2024.

But this month, worries that stubborn inflation would lead the Fed to keep rates high have returned, compounded by the widening conflict in the Middle East, with Israel striking Iran early on Friday.

“It’s clearly bleak,” said Andrew Brenner, head of international fixed income at National Alliance Securities. And the unease is not just apparent in the stock market.