Inflation Cools in Eurozone, Nearing Central Bank’s Target

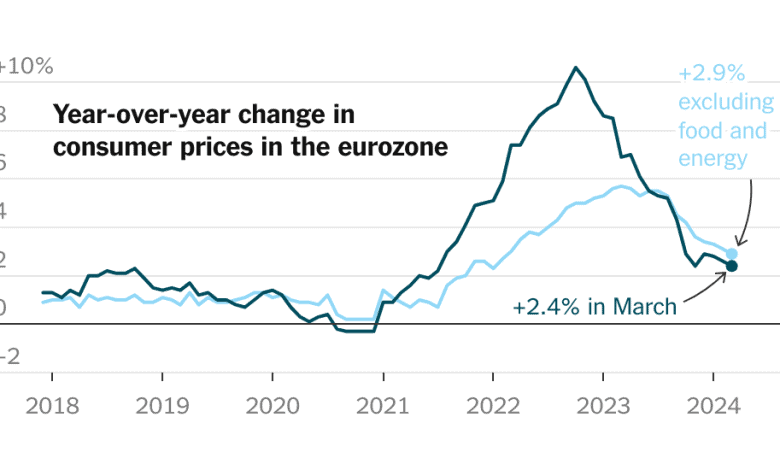

The annual inflation rate across most economies in Europe eased for the third month in a row, nearing the target set by the European Central Bank. Consumer prices in the 20 countries that use the euro rose 2.4 percent in the year through March, down from 2.6 percent the month before, the European Union reported on Wednesday.

The rate was slightly lower than economists expected and brought overall inflation closer to the 2 percent target set by the E.C.B., which will hold its next meeting to set interest rates on April 11.

The central bank also keeps a close eye on core inflation, which strips out volatile food and energy prices. That dipped to 2.9 percent in the year through March in the eurozone, ticking below the 3-percent mark for the first time since Russia’s full-scale war against Ukraine broke out in February 2022, driving up energy prices.

Germany, the eurozone’s largest economy, saw consumer prices rise at an annual rate of 2.3 percent in March, its slowest inflation since June 2021.

The latest numbers will support the notion that the E.C.B. could soon begin to cut interest rates, which the bank held steady last month, at 4 percent. But analysts believe the central bank will wait for more evidence that the cooling trend is holding.

“While core inflation eased, the stubbornness of services inflation and the desire for the E.C.B. for more wage data makes an April rate cut unlikely,” Rory Fennessy, an economist at Oxford Economics, wrote in a note.

Inflation in the United States has cooled but faced a bumpy path, reinforcing the Federal Reserve’s decision to proceed cautiously on potential interest rate cuts. The Bank of England has also held rates at relatively high levels amid signs that inflation in Britain is moderating.