Inflation Was Hotter Than Expected in March, Unwelcome News for the Fed

A closely watched measure of inflation remained stronger than expected in March, worrying news for Federal Reserve officials who have become increasingly concerned that their progress on lowering price increases might be stalling.

The surprisingly stubborn inflation reading raised doubts among economists about when — and even whether — the Fed will be able to start cutting interest rates this year.

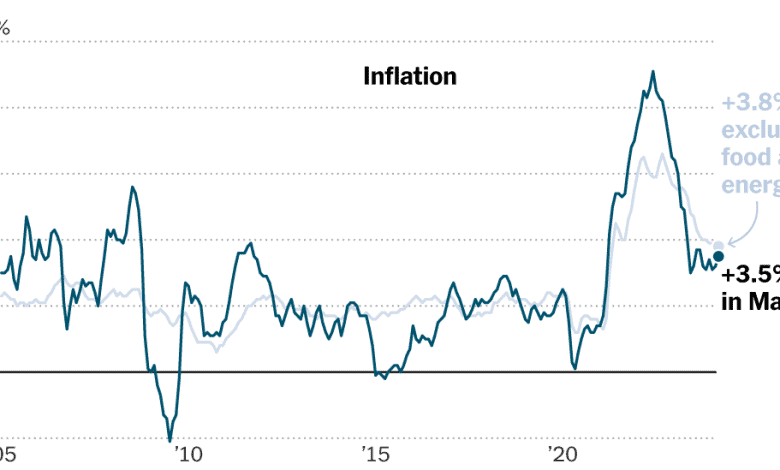

The Consumer Price Index climbed 3.8 percent on an annual basis after stripping out food and fuel prices, which economists do in order to get a better sense of the underlying inflation trend. That “core” index was stronger than the 3.7 percent increase economists had expected, and unchanged from 3.8 percent in February. The monthly reading was also stronger than what economists had forecast.

Counting in food and fuel, the inflation measure climbed 3.5 percent in March from a year earlier, up from 3.2 percent in February and faster than what economists anticipated. A rise in gas prices contributed to that inflation number.

This week’s inflation figures come at a critical juncture for the Fed. Central bankers have been hoping to confirm that warmer-than-expected inflation figures at the start of the year were just a seasonal quirk, not evidence that inflation is getting stuck well above the 2 percent target. Wednesday’s report offers little comfort that the quick early 2024 readings have not lasted.

“It is what it is: It’s a stronger-than-expected number, and it’s showing that those price pressures are strong across goods and services,” said Blerina Uruci, chief U.S. economist at T. Rowe Price. “It’s problematic for the Fed. I don’t see how they can justify a June cut with this strong data.”