2023: The Year You Didn’t Buy a House

The year ended disappointingly for many American home buyers — fewer than 16 percent of homes for sale in 2023 were affordable to local median earners, according to a study by Redfin. That’s the lowest rate since at least 2013, the year Redfin began tracking prices, when 50 percent of homes were affordable to local median earners. In 2019, before the pandemic, 40 percent of listed homes were affordable. In 2022, only 21 percent were.

For the study, researchers defined “affordability” as housing that costs no more than 30 percent of income. They assumed a relatively low down payment of 5 percent, a 30-year-fixed-rate mortgage with the interest rate current to the month the home entered the market, plus homeowners insurance and private mortgage insurance. Prices and incomes in the 97 most populous U.S. metro areas were examined for the study.

The U.S. Census Bureau’s American Community survey was used to parse earnings data, and its demographic breakdown revealed deep racial disparities when it comes to home buying: Only 7 percent of homes were affordable for median-earning Black households, and 10 percent for median-earning Hispanic/Latino households. But 22 percent of listings were affordable to median-earning white households, and 27 percent to median-earning Asian households.

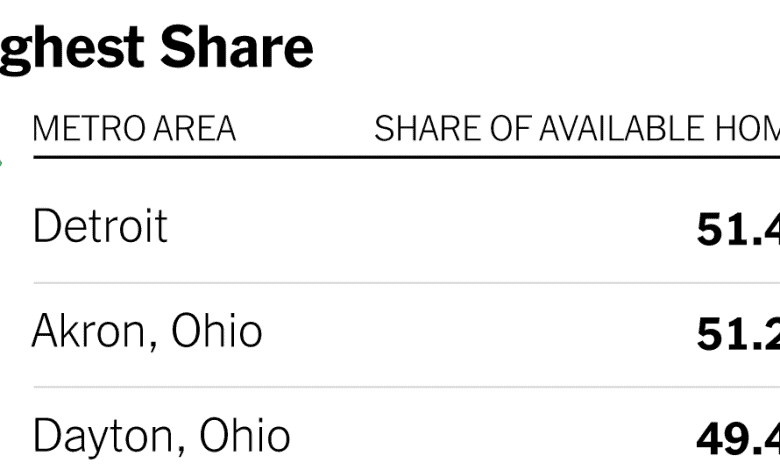

None of this is a surprise given 2023’s higher interest rates and low inventory. But in some areas, especially the Midwest, a much larger share of homes were affordable to all. Detroit, and the Ohio metros of Akron and Dayton, had the highest shares of affordable homes for median earners — about 50 percent. But out west, in wealthy metros like San Francisco, Los Angeles and Oxnard, Calif., fewer than one in 300 listed homes were affordable to the typical household.

The good news is, housing affordability is expected to improve in 2024 as mortgage rates deflate and more homes land on the market.

For weekly email updates on residential real estate news, sign up here.